If you’re like 51% of pre-retirement workers, you would consider a portion of your retirement income to be guaranteed.¹ However, like many others, you may find yourself falling short of this goal — even with Social Security benefits. There are several reasons why this may be the case.

Early filing, taxes and Medicare costs can all influence how much you’ll see in your Social Security benefits each month. Here’s a closer look at the factors that can impact benefits after you file for Social Security.

#1 You need to file for Social Security early

When it comes to Social Security benefits and retirement, age 67 is the new 65. But, for many people, delaying retirement until full retirement age or later is not an option. The cost of filing for Social Security early in retirement can be substantial, especially considering how much guaranteed income you can gain or lose throughout retirement.

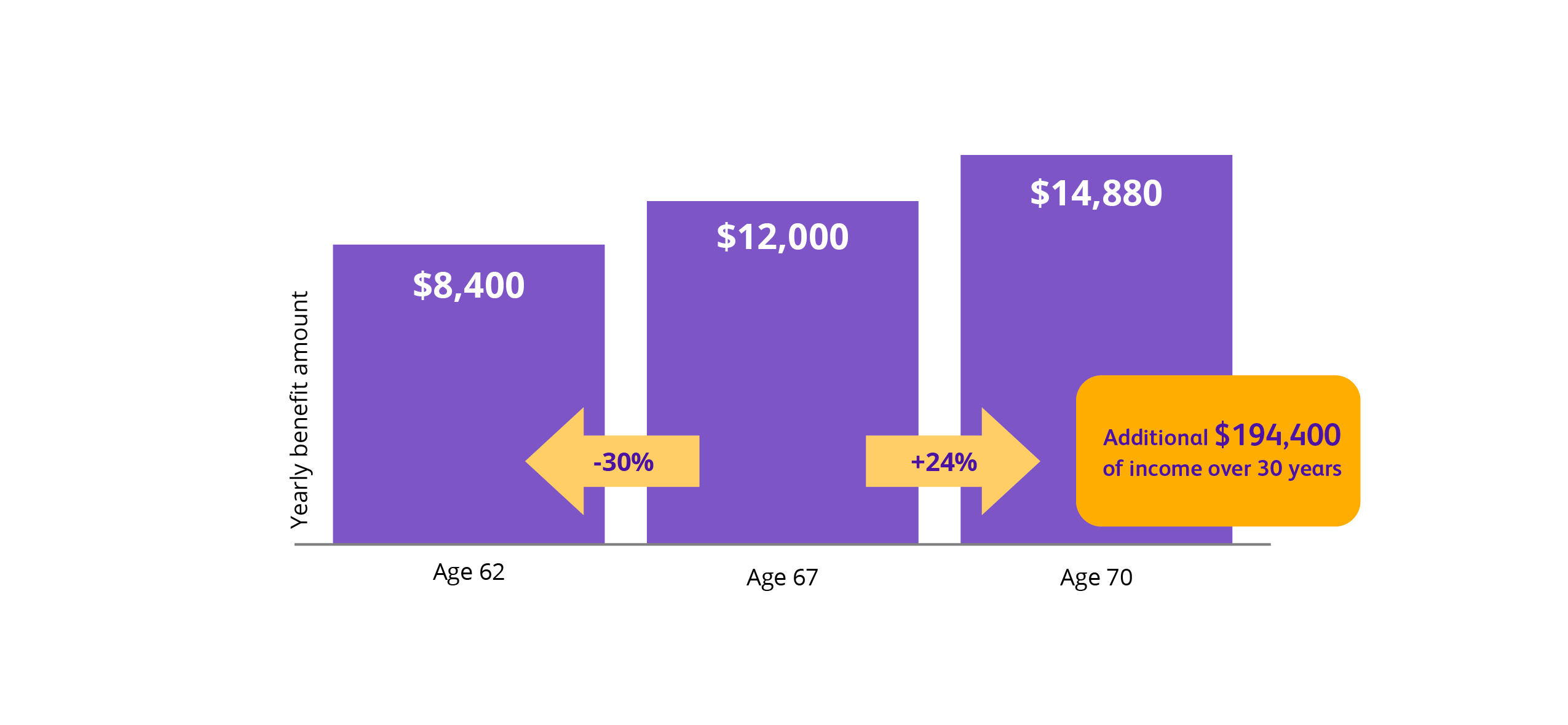

The example below assumes annual benefits of $12,000 per year ($1,000 a month) if an individual, born in 1961, filed at full retirement age. Delaying Social Security benefits until age 70 could mean almost $200,000 more in retirement income.

This chart is hypothetical and for illustrative purposes only. It is intended to demonstrate how early or delayed retirement impacts Social Security benefits. The chart is not intended to forecast, imply or guarantee performance of any investment or retirement income.

Waiting to file for Social Security benefits

Waiting to file for Social Security to maximize your benefits has financial advantages. But what if you don’t think a delay in filing is or will be an option? Thankfully, solutions like annuities are one way you can prepare financially to file later, even if you have to retire early.

An annuity is a contract between you and an insurance company that provides a guaranteed income stream in retirement. You pay a premium in exchange for set payments designed to last the rest of your life.

Annuities can help in two ways:

In the short term it can help bridge the income gap, enabling you to retire when you want and still postpone filing until you reach full retirement age, or even age 70, to maximize your Social Security benefits.

In the long term, it can strengthen your overall retirement strategy by increasing the percentage of your income that is guaranteed for life.

#2 Social Security benefits may be taxable

According to the Social Security Administration, nearly half of people receiving benefits will pay taxes on them.2 While money withdrawn from an IRA, pension or other investment may not be considered earnings, they may impact how your benefits are taxed.

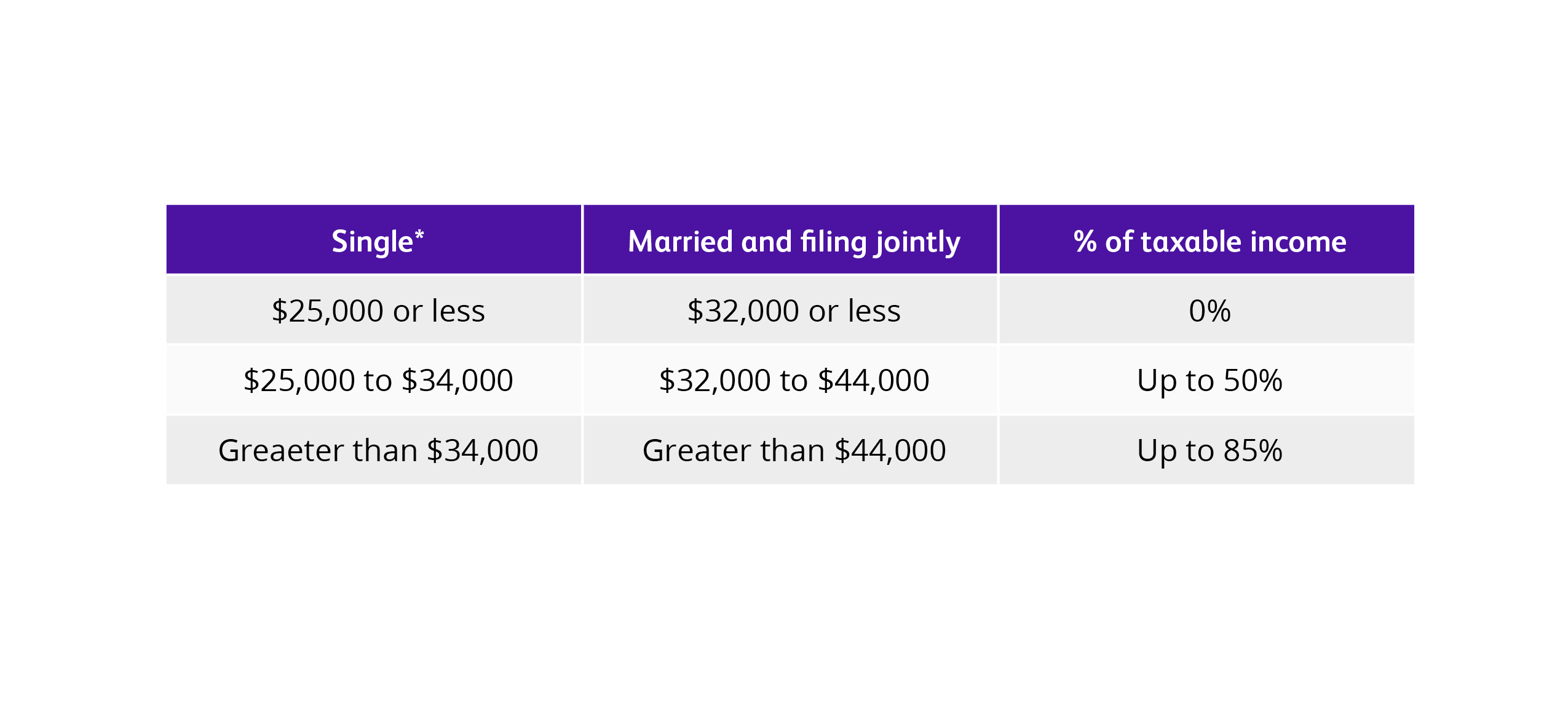

Here’s how much is taxable based on income amount and IRS filing status.

*Includes head of household, qualifying survivor, or married filing separately and lived apart from your spouse for all of 2022. Source: IRS publications 915, February 7, 2023. SSA.gov.

Protect your level of guaranteed income once benefits begin

You may not realize how much of an impact taxes can have on what you actually receive in Social Security benefits. By making up the difference with a guaranteed income stream, you can feel confident whether you retire at full retirement age or before.

#3: Medicare Part B premiums are deducted from Social Security benefits

You may be surprised to learn that your Medicare Part B costs are automatically deducted from your Social Security benefits. Part B covers certain doctors’ services, outpatient care, medical supplies and preventive services.

The higher your income, the more you’ll have to pay in Medicare premiums. You can expect your Social Security benefit to be reduced, sometimes by a few thousand dollars annually, depending on your Part B costs.3

Help protect your level of guaranteed income

An annuity with a guaranteed lifetime income benefit can help limit the impact of Medicare premium costs. After you start receiving Social Security benefits, payments from an annuity can help cover reductions in your benefits as well as:

- Supplement future lifestyle goals

- Pay for unexpected health care costs not covered by Medicare

- Plan for rising costs in retirement with withdrawal payments that increase over time

Ultimately, this strategy can help you maintain — or even increase — your guaranteed income.

Set yourself up to receive the highest monthly benefits possible

With concerns about potential reductions in Social Security, attaining the highest level of benefits can help you feel more confident about the future.

An annuity is one option to help supplement an expected reduction in Social Security benefits or when situations arise that are out of your control. Increasing your monthly guaranteed income can help plan for what’s ahead, no matter what comes your way.

Protective offers multiple types of annuities based on your needs. Talk with your financial professional to find out if an annuity makes sense for you and your retirement goals.

Explore these additional topics:

- How working after you retire can affect your social security benefits

- Know your Social Security retirement facts

- Retirement income: Is it taxable?

2 https://www-origin.ssa.gov/benefits/retirement/planner/taxes.html

3 https://www.ssa.gov/benefits/medicare/medicare-premiums.html

As you determine what annuity might be right for you, remember they are intended as vehicles for long-term retirement planning, which is why withdrawals reduce an annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals from annuities may also be subject to income tax and, if taken prior to age 59 ½, an additional 10% IRS tax penalty may apply. Because Protective and its representatives do not offer legal or tax advice, it is important that you talk with your own legal and tax advisor about your specific tax situation.

This material contains statements regarding the availability of and details surrounding the Social Security program. These statements represent only our current understanding of Social Security in general and is not to be considered legal or tax advice by consumers. Details of the Social Security program are subject to change at any time.

__

Protective refers to Protective Life Insurance Company (PLICO), Nashville, TN and Protective Life and Annuity Insurance Company (PLAIC), Birmingham, AL. Securities offered by Investment Distributors, Inc. (IDI), a broker-dealer and the principal underwriter for registered products issued by PLICO and PLAIC. Product guarantees are backed by the financial strength and claims-paying ability of the issuing company.

Protective® is a registered trademark of PLICO. The Protective trademarks, logos, and service marks are property of PLICO and are protected by copyright, trademark, and/or other proprietary rights and laws.

WEB.5872328.07.24