Annuities can help meet your retirement needs

An annuity is a retirement investment vehicle that can offer benefits, including:

Interested in learning more about annuities?

Protective’s annuity options offer ways to grow your retirement nest egg based on your risk tolerance, while also deferring taxes on that growth. And when you’re ready to retire, you have a wide variety of options to guarantee that income stream for as long as you need - even for the rest of your life.

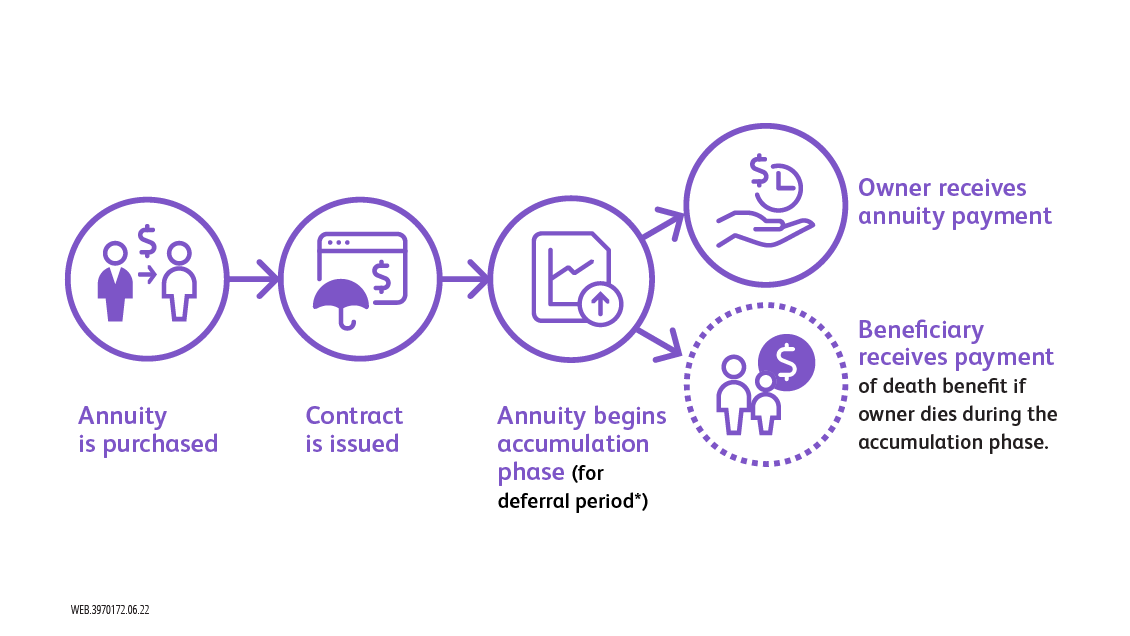

Annuities can be purchased to start paying immediately or to postpone payouts to the future.

The payouts from an annuity contract can be made as one lump sum or as a series of payouts over time based on your needs.

The information below walks you through several uses for annuities and then reviews specific categories and how they work.

- Accumulation — A period of time when the owner, or annuitant, is accumulating value in the annuity. This will usually occur before an individual retires.

- Distribution — The payout phase of an annuity comes when the accumulated value is distributed – either via a lump sum or a series of payments over time.

Immediate annuities and deferred annuities

Types of deferred annuities and their features

What type of annuity is right for you?

Product guarantees are backed by the financial strength and claims-paying ability of the issuing company. Withdrawals made during an annuity's surrender period may be subject to surrender charges. Annuity withdrawals made prior to age 59 1/2 may be subject to a 10% penalty tax.

Common questions about annuities

An annuity is a contract between you and an insurance company. The insurance company invests your payments based on the type of annuity you select, and you choose the payout frequency. They are often used as a retirement savings vehicle and can help individuals avoid the risk of outliving their money.

Annuities work like a contract between you and an insurance company. You agree to pay a single lump sum or make payments over time. The insurance company invests your money in different ways depending on the type of annuity you select. You then choose the payout option that works best for your financial goals.

Annuity pay out amounts depend on the type of product you select. Talk to your financial professional to decide which annuity is the best fit for your goals and budget.

Taxes will depend on the annuity you select and the withdrawals you take. Many annuities are tax-deferred, so you can wait to pay taxes until you start receiving the funds. This saves you money in the immediate future and provides opportunities for higher gains.

Get a retirement annuity with Protective Life

The Learning Center can help you understand retirement annuity options

Variable annuities issued by Protective Life Insurance Company (PLICO) Nashville, TN, in all states except New York and in New York by Protective Life & Annuity Insurance Company (PLAIC), Birmingham, AL. Securities offered by Investment Distributors, Inc. (IDI). IDI is the principal underwriter for registered insurance products issued by PLICO and PLAICO, its affiliates.

As you determine what annuity might be right for you, remember they are intended as vehicles for long-term retirement planning, which is why withdrawals reduce an annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Annuities also may be subject to income tax and, if taken prior to age 59 ½, an additional 10% IRS tax penalty may apply. Because Protective and its representatives do not offer legal or tax advice, it is important that you talk with your own legal and tax advisor about your specific tax situation.

Product guarantees are backed by the financial strength and claims-paying ability of the issuing company.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Prospectuses may be obtained by contacting PLICO at 800.265.1545.

An indexed annuity is not an investment in an index, is not a security or stock market investment and does not participate in any stock or equity investments.

Annuities are not a deposit, not insured by any federal government agency, carry no bank or credit union guarantee, are not FDIC/NCUA insured and may lose value.

To exercise your privacy choices,

To exercise your privacy choices,