What is term life insurance?

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. With a term life insurance policy, you pay regular premiums to the insurance company. If you pass away during the policy term, your beneficiaries receive a cash benefit, known as the death benefit. At its core, a term life insurance policy is a contract between the policyholder and the insurance company, offering financial protection for your loved ones in the event of your untimely death.

Key features of term life insurance

Term life insurance policies have several key features that distinguish them from other types of life insurance:

- Coverage periods — Policies are available for specific terms, usually 10, 15, 20 or 30 years.

- Premium payments — You pay regular premiums to maintain coverage throughout the policy term.

- Death benefit — If you pass away during the policy term, your beneficiaries receive a tax-free lump sum payment.

- Simplicity — Term life insurance is straightforward and easy to understand compared to other types of life insurance.

- Affordability — Generally, term life insurance offers the most coverage for the lowest cost, especially for younger, healthier individuals.

How a term life insurance policy works

To understand how a term life insurance policy works, let's break down the process from selection to payout.

Selecting a coverage amount

When choosing your coverage amount, think about the income that you need to replace to support your beneficiaries. Factor in any outstanding debts that you need to clear, including mortgages, and anticipated expenses such as college tuition. Weigh these against your existing assets and savings.

Choosing your term length

The term length is the duration for which your policy remains active, and it should be matched to your financial obligations and goals. For example, if you have 30 years remaining on your mortgage, a 30-year term policy might be appropriate. You might want coverage until your youngest child graduates from college, or you might want to choose a term that covers you until your planned retirement age. Remember, longer terms generally have higher premiums but provide extended protection.

Naming your beneficiary

A life insurance beneficiary is the person or entity who receives the death benefit when you pass away. Choosing a beneficiary is a crucial decision that requires careful consideration. Be specific when naming beneficiaries, and consider naming multiple beneficiaries or contingent beneficiaries as backups. Review your beneficiary designations regularly, as life changes like marriage, divorce or births may necessitate updates.

Submitting an application

The application process for term life insurance involves several steps:

- Completing a questionnaire — This includes basic information about your health, lifestyle and family medical history.

- Medical exam — Many policies require a basic medical exam, including blood tests and vital sign measurements.

- Underwriting process — The insurer assesses your risk based on your application and medical exam results.

- Application review — The insurer makes a final decision on your application and determines your premium rate. This process can take up to six weeks, though some insurers offer accelerated underwriting for faster approval.

Receiving your policy

Once approved, you'll receive your policy documents. Review the policy carefully to ensure all details are correct, and when you're satisfied you can make your first premium payment to activate the policy. Set up an automated system for regular premium payments to maintain coverage. It's also important to store the policy documents in a safe place and inform your beneficiaries of their location so that they can handle matters upon your death.

Renewing or converting your policy

As you approach the end of your term, you have options. Some policies offer a renewable term life insurance option, allowing you to extend coverage without a new medical exam, though premiums typically increase significantly. Many term policies include a conversion option, allowing you to convert to a whole life insurance policy without proving insurability. Alternatively, you can apply for a new term policy, which may require a new medical exam but could offer better rates if your health has improved.

Types of term life insurance policies

Term life insurance comes in several varieties to suit different needs and preferences:

Level premium

Level term life insurance is the most common type. With this policy, your premium and death benefit remain constant throughout the term. This predictability makes budgeting easier and ensures consistent coverage.

Yearly renewable term

Yearly renewable term policies offer coverage for one year at a time, with the option to renew annually without proving insurability. Premiums start lower but increase each year, potentially becoming very expensive over time.

Return of premium

Return of premium life insurance policies refund your premiums if you outlive the policy term. These policies have higher premiums but offer the potential to recoup your investment if you outlive the policy.

Guaranteed issue

Guaranteed issue life insurance policies don't require a medical exam or health questions. They're typically more expensive and offer lower coverage amounts but can be a good option for those with health issues who might not qualify for standard policies.

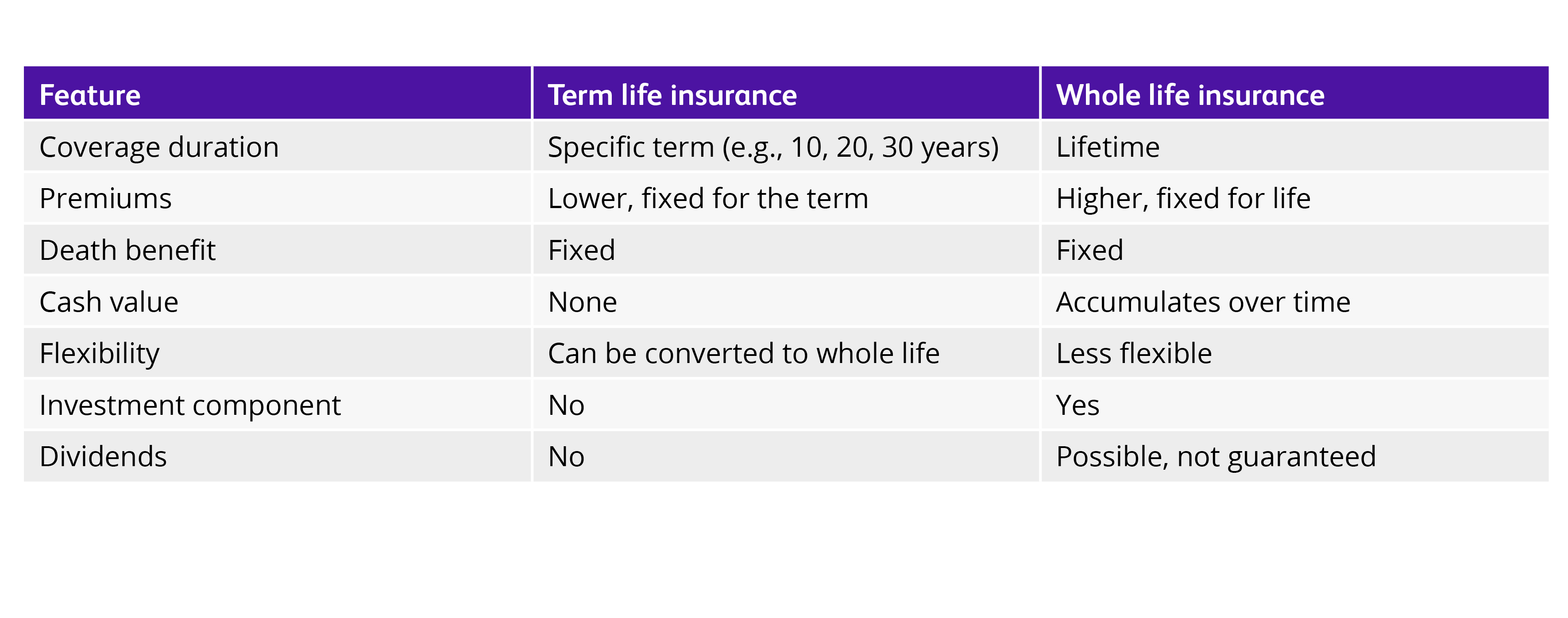

Term life insurance vs. whole life insurance

While term life insurance provides coverage for a specific period, whole life insurance offers lifelong coverage and includes a cash value component. Term life insurance typically has lower premiums, no cash value accumulation and a simpler structure, but expires after the term. Whole life insurance has higher premiums, builds cash value over time, has a more complex structure and provides lifelong coverage as long as the policy remains in-force.

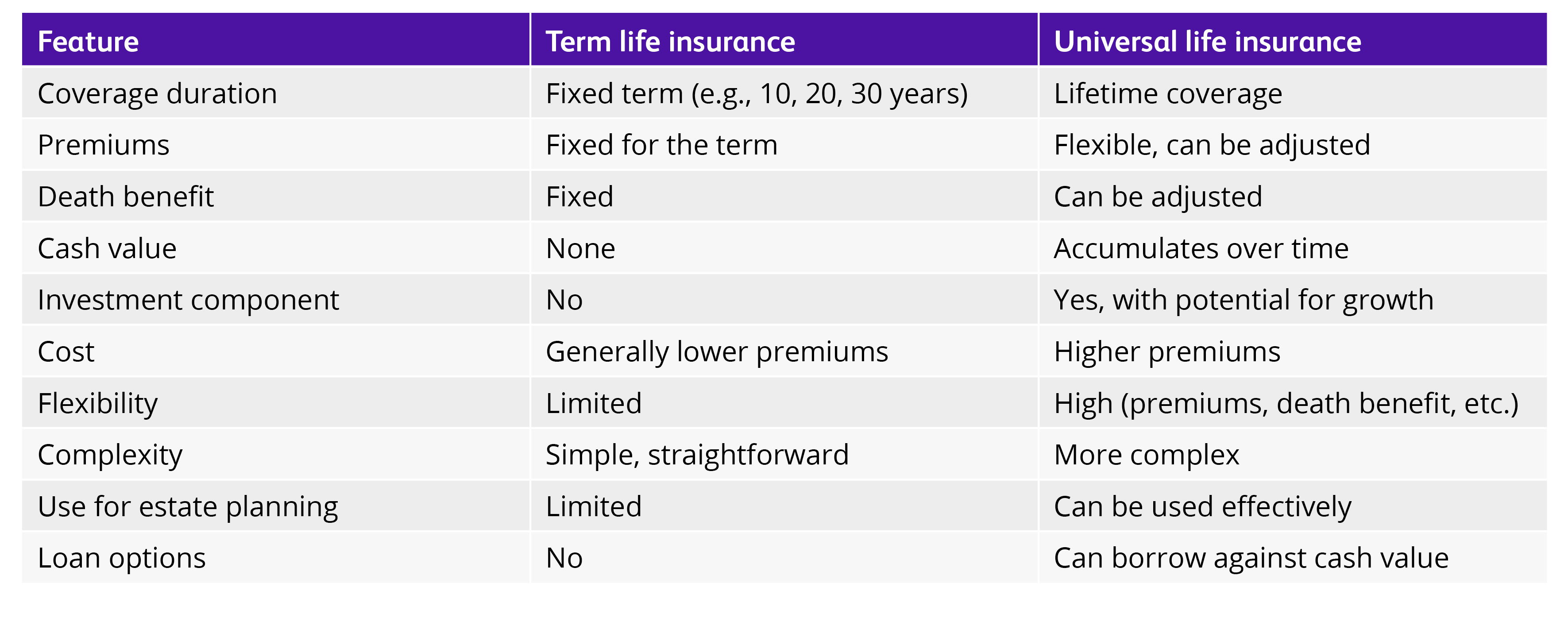

Term life vs. whole life insurance choices depend on your specific needs and financial goals. While term life offers affordable protection for a set period, whole life offers lifelong coverage and can be part of your overall financial strategy. Learn more about the benefits of whole life insurance to determine which option suits you best. Term life insurance vs. universal life insurance Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life. Here's a comparison of term life insurance and universal life insurance:

Term life vs. whole life insurance choices depend on your specific needs and financial goals. While term life offers affordable protection for a set period, whole life offers lifelong coverage and can be part of your overall financial strategy. Learn more about the benefits of whole life insurance to determine which option suits you best. Term life insurance vs. universal life insurance Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life. Here's a comparison of term life insurance and universal life insurance:

Advantages of term life insurance

Term life insurance offers several advantages:

- Affordability — Term life insurance typically offers the most coverage for the lowest cost.

- Simplicity — Term life insurance is easy to understand and manage.

- Flexibility — You can choose a term that matches your specific needs.

- High coverage amounts — You can often secure much higher death benefits for less money than with permanent policies.

- Convertibility — Many policies offer the option to convert to permanent insurance later.

Disadvantages of term life insurance

Despite its benefits, term life insurance has some drawbacks:

- No cash value — Unlike permanent policies, term life policies don't build cash value over time.

- Coverage expiration — If you outlive your policy, there's no payout, and securing new coverage may be more expensive or difficult.

- Increasing premiums — If you renew or purchase a new policy after your term ends, premiums will likely be higher due to increased age.

- Limited features — Term policies typically don't offer the additional benefits or riders that some permanent policies do.

If you're unsure which type of policy is right for you, consider using a life insurance policy finder tool to explore your options.

How much does term life insurance cost?

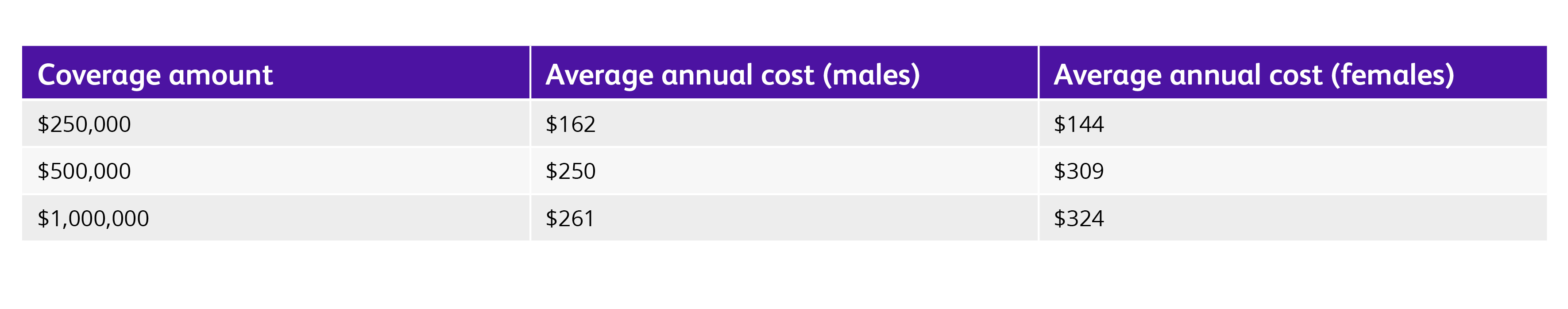

The cost of term life insurance varies based on several factors: According to data from Forbes Advisor, here are the average annual costs for a 20-year term life insurance policy for a healthy 30-year-old in the United States as of August 2024:

These are average figures, and your actual costs may be higher orlower depending on your individual circumstances and the issuing insurance company. Factors that can increase your premiums include age (younger applicants generally pay lower premiums), health (better health typically results in lower premiums), coverage amount (higher death benefits increase the cost), term length (longer terms usually have higher premiums) and lifestyle (factors like smoking can increase costs). Dangerous occupations or hobbies can also elevate premiums.

Many insurers offer online quote tools that can give you a quick estimate based on your specific details. You can use a life insurance calculator or get a quote for term life insurance policies to explore your options.

How to get the best rates on term life insurance

You can secure an optimum rate for life insurance by making full use of your options when researching a policy.

Compare quotes

Shopping around is crucial to finding the best rates. Get quotes from multiple insurers, ensure you're comparing similar coverage amounts and terms, consider the financial strength and reputation of the insurance companies and look beyond just the premium–consider policy features and conversion options, too.

Maintain a healthy lifestyle

Your health significantly impacts your premium rates. Consider lifestyle changes such as quitting smoking or using tobacco products, maintaining a healthy weight, exercising regularly, managing any chronic conditions and limiting alcohol consumption.

Consider policy riders

Policy riders can enhance your coverage. Common riders include waiver of premium (waives premiums if you become disabled), accidental death (provides additional payout for accidental death), child rider (extends coverage to your children) and terminal illness (allows early payout if you are diagnosed with a terminal illness).

Frequently asked questions about term life insurance

How does term life insurance pay out?

Term life insurance pays out a lump sum death benefit or series of payments to your designated beneficiaries if you pass away during the policy term. The payout is typically tax-free.

What happens to term life insurance at the end of the term?

If you outlive your policy term, the coverage simply ends. You won't receive any payout or refund of premiums unless you have a return of premium policy, which will involve a higher premium.

Can you cash out a term life insurance policy?

Term life insurance policies don't build cash value and cannot be cashed out.

What happens if my term life insurance policy expires?

When your term life insurance expires, your coverage ends. You may have the option to renew the policy or convert it to a permanent policy.

What happens if I can't afford my term life insurance premiums?

Most policies have a grace period (typically 30 days) during which you can pay without losing coverage. If you can't pay within this period, your policy will lapse, and you'll lose coverage. Some insurers may offer options to reduce your coverage amount to lower the premium or to reinstate a lapsed policy within a certain timeframe. These options will vary across insurers and are processed on a case-by-case basis.

WEB.5924385.08.24