Variable annuities

Benefits of variable annuities

What makes annuities from Protective different?

How do variable annuities work?

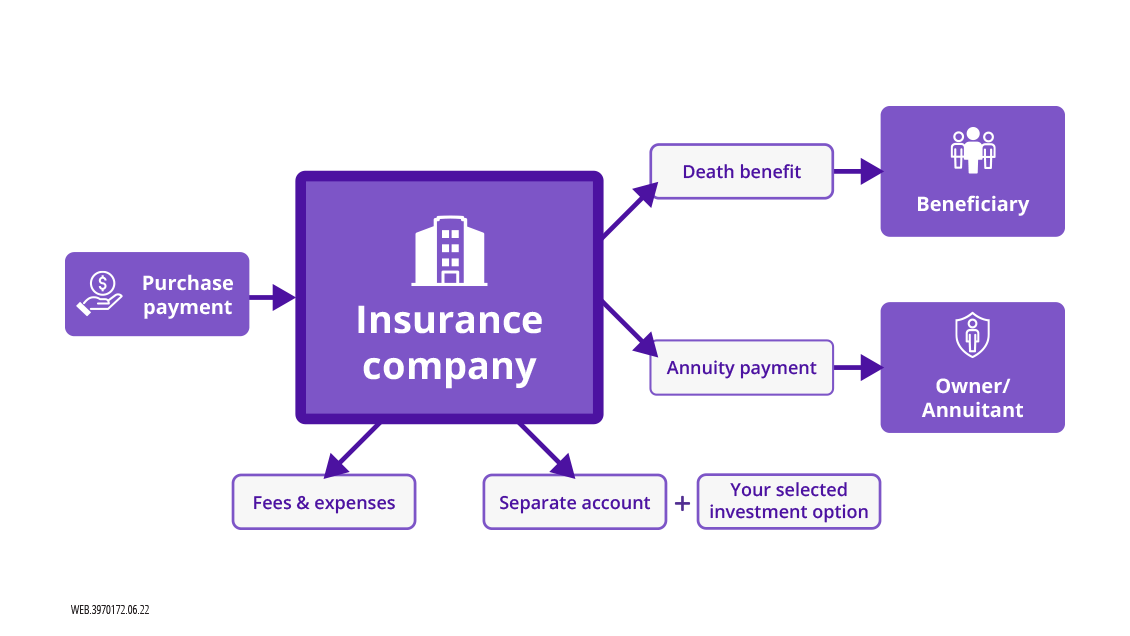

Variable annuities are a type of deferred annuity, which means that the money invested is intended to grow for a while before it begins to provide any payout. While they offer the potential for greater earnings compared to other types of annuities, variable annuities also come with greater investment risk. So investors need to understand their goals and risk tolerance as they decide whether a variable annuity is right for them. Here’s an illustration on how they work:

Common questions about variable annuities

A variable annuity offers the potential for higher earnings than other types of annuities, although this comes with increased risk. Payments are allocated to variable annuity subaccounts, which in turn invest in stocks, bond funds, or money market funds. They're often used to grow retirement savings and later as an income source.

Variable annuities work like other annuities, but with the ability to allocate payments among a choice of subaccounts. The performance of those subaccounts, which invest in stocks, bond funds, or money market funds, determine your earnings. At a future date, you select how you would like to receive payments based on available options.

Get a retirement annuity with Protective Life

The Learning Center can help you get smart about retirement annuity options

As you determine what annuity might be right for you, remember they are intended as vehicles for long-term retirement planning, which is why withdrawals reduce an annuity’s remaining death benefit, contract value, cash surrender value and future earnings. Withdrawals from annuities may also be subject to income tax and, if taken prior to age 59 ½, an additional 10% IRS tax penalty may apply. Because Protective and its representatives do not offer legal or tax advice, it is important that you talk with your own legal and tax advisor about your specific tax situation.

Variable annuities are considered securities contracts and are regulated by federal securities laws and must be sold with a prospectus.

Investors should carefully consider the investment objectives, risks, charges and expenses of a variable annuity, any optional protected lifetime income benefit, and the underlying investment options before investing. This and other information is contained in the prospectuses for a variable annuity and its underlying investment options. Investors should read the prospectuses carefully before investing. Prospectuses may be obtained by contacting PLICO at 800.265.1545.

WEB.506937.05.20