Immediate Annuities

Benefits of immediate annuities

Ready to convert assets into an immediate and steady stream of income?

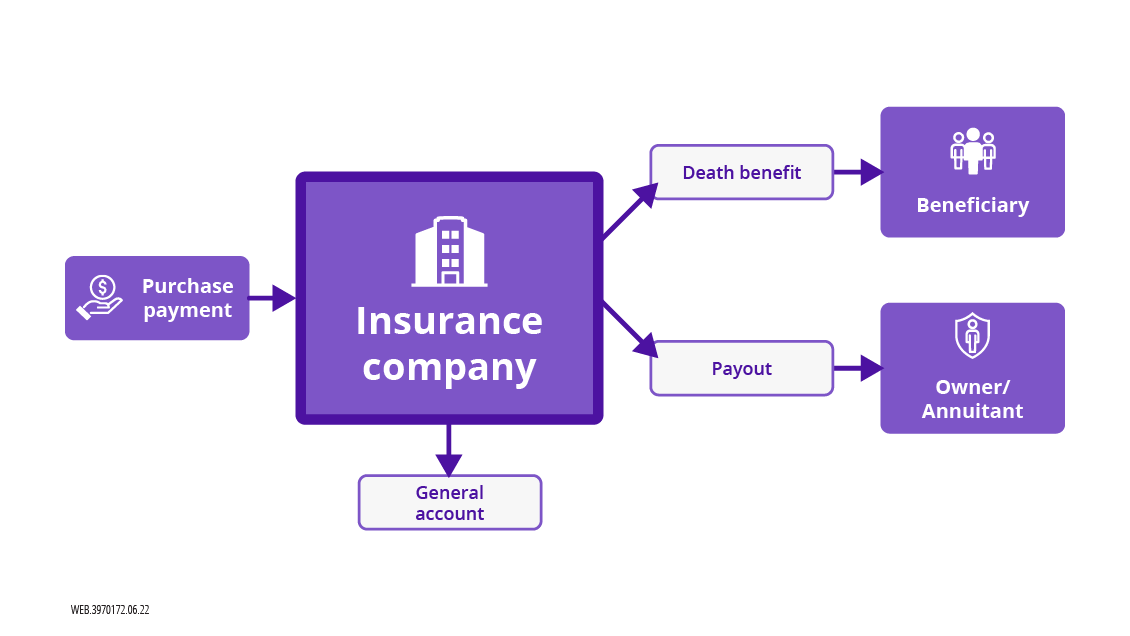

How do immediate annuities work?

Income stream options for immediate annuities

- Life only annuity: This option ensures that the immediate annuity will provide guaranteed income over the lifetime of an individual. When that person dies, the payments stop, even if only one payment has been made.

- Joint life annuity or Joint and Survivor annuity: As the name implies, this option allows an immediate annuity to provide joint coverage for two individuals. So that you maintain a selected income stream through the death of the second individual. Based on your contract, the survivor can receive a portion of the annuity payments or the full payments.

- Period certain annuity: This type of immediate annuity guarantees that the contract pays out for a certain period of time. Payments continue to your beneficiary for the remainder of the period should you die within that time.

- Life with period certain: Payments are made for a certain number of years or for your lifetime, whichever is longer. If you die during the specified period, the remaining payments are made to your beneficiary.

Common questions about immediate annuities

An immediate annuity enables you to convert the money you have into a predictable stream of income to help with retirement. Immediate annuity payments can be set to payout for your lifetime — so you won't have to worry about outliving this income.

Immediate annuity payments begin immediately, or you can delay them for up to 12 months. An immediate annuity can also provide payments to a joint annuitant or beneficiary.

Get a retirement annuity with Protective Life

The Learning Center can help you get smart about retirement annuity options

Neither Protective Life nor its representatives offer legal or tax advice. Any tax-related statements made in this material are based upon general information and represent only one interpretation of current federal tax law as it relates to annuities. Moreover, the tax treatment of annuities is subject to change. Please consult your legal or tax advisor regarding your individual situation before making any tax-related decisions.

Single premium immediate annuity contracts issued under policy form series IPD-2112 (PLICO) and AF-2112 (PLAIC). Policy form numbers, product availability and product features may vary by state.

WEB.506988.05.20